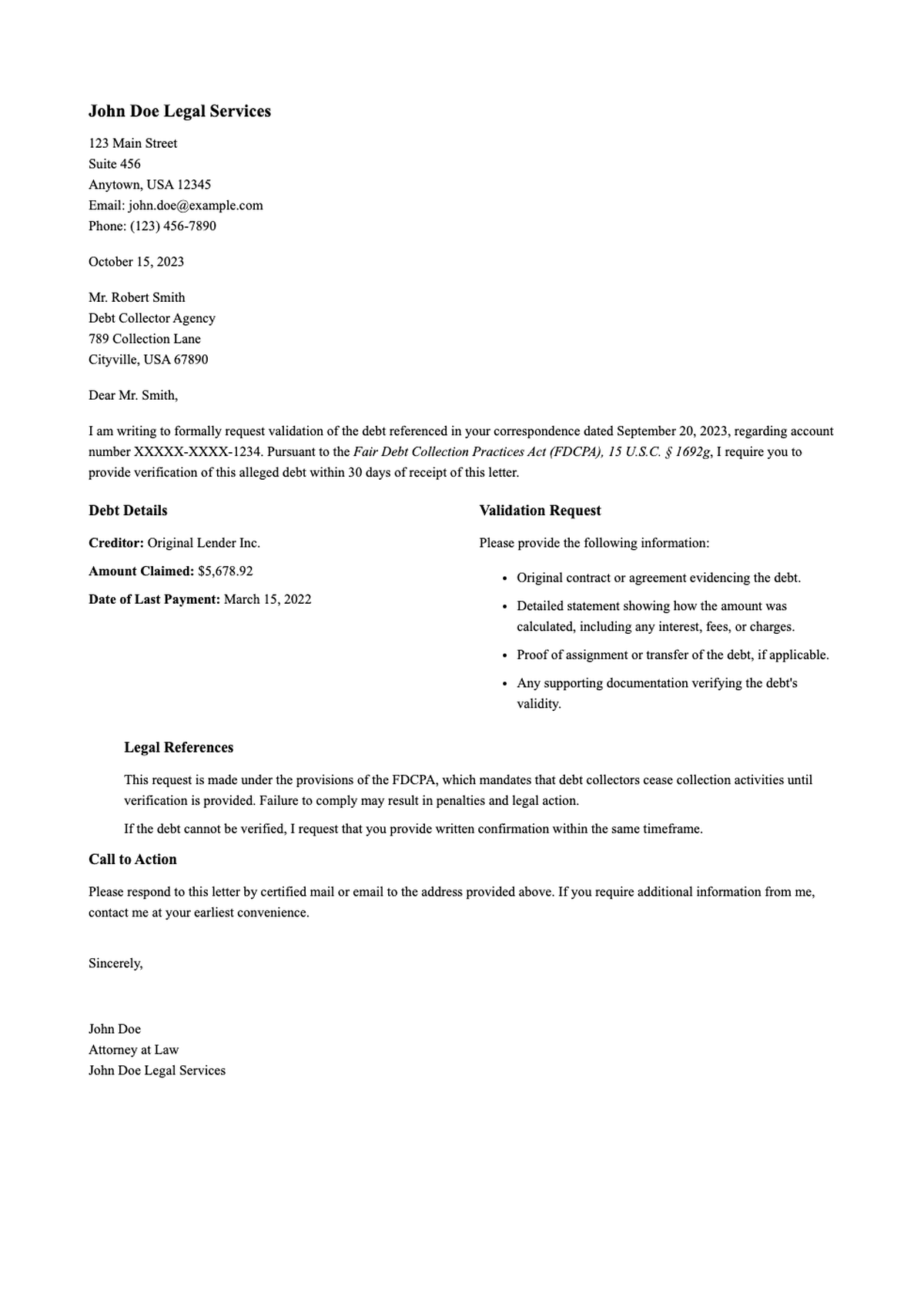

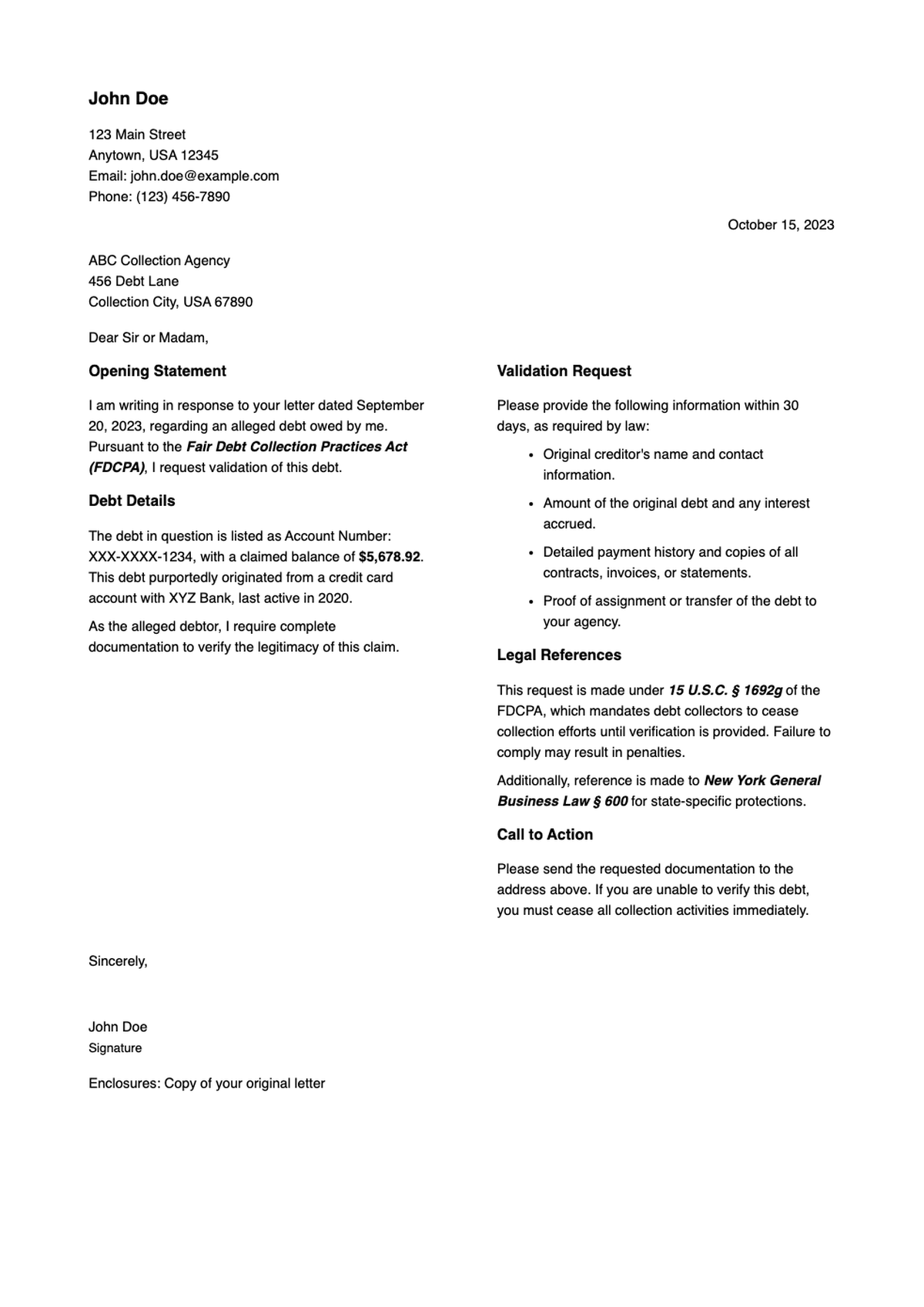

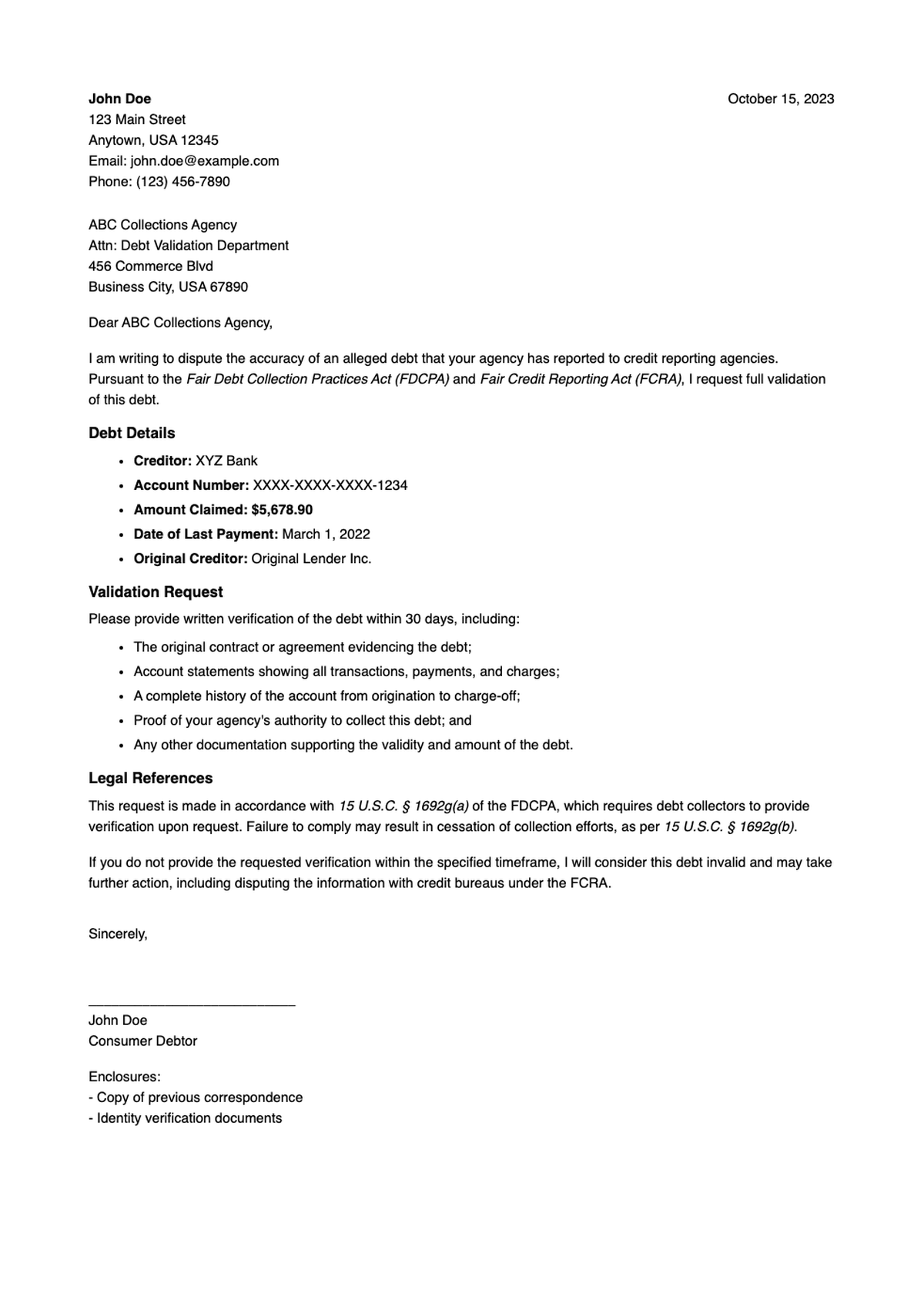

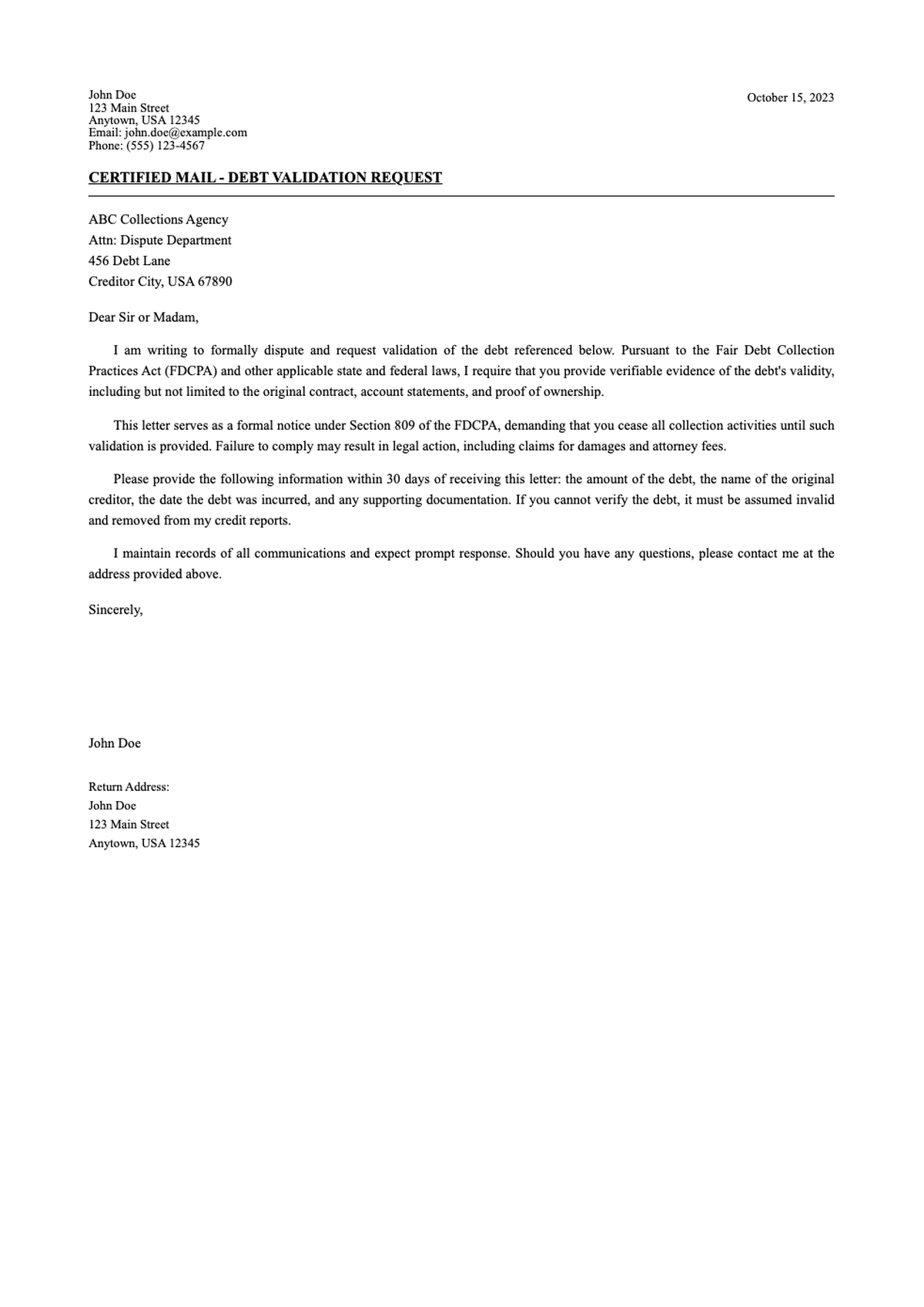

Edit Debt Validation Letter Templates Online for Free

Assert your rights against debt collectors with AI Formatter's Debt Validation Letter templates. Ensure you request proper verification under the Fair Debt Collection Practices Act.

Showing 20 of 249 templates

Frequently Asked Questions About Our Templates

Important information about using debt validation letters effectively.

- Are these Debt Validation Letter templates free?

- Yes, our Debt Validation Letter templates are free to download. We believe everyone should have access to the tools needed to protect their financial rights. Simply download, customize with your details, and send to exercise your rights under federal law. Debt collection can be intimidating, but knowing your rights empowers you to take control. These templates are designed to be legally compliant and effective in stopping harassment while requiring collectors to prove they have the right to collect.

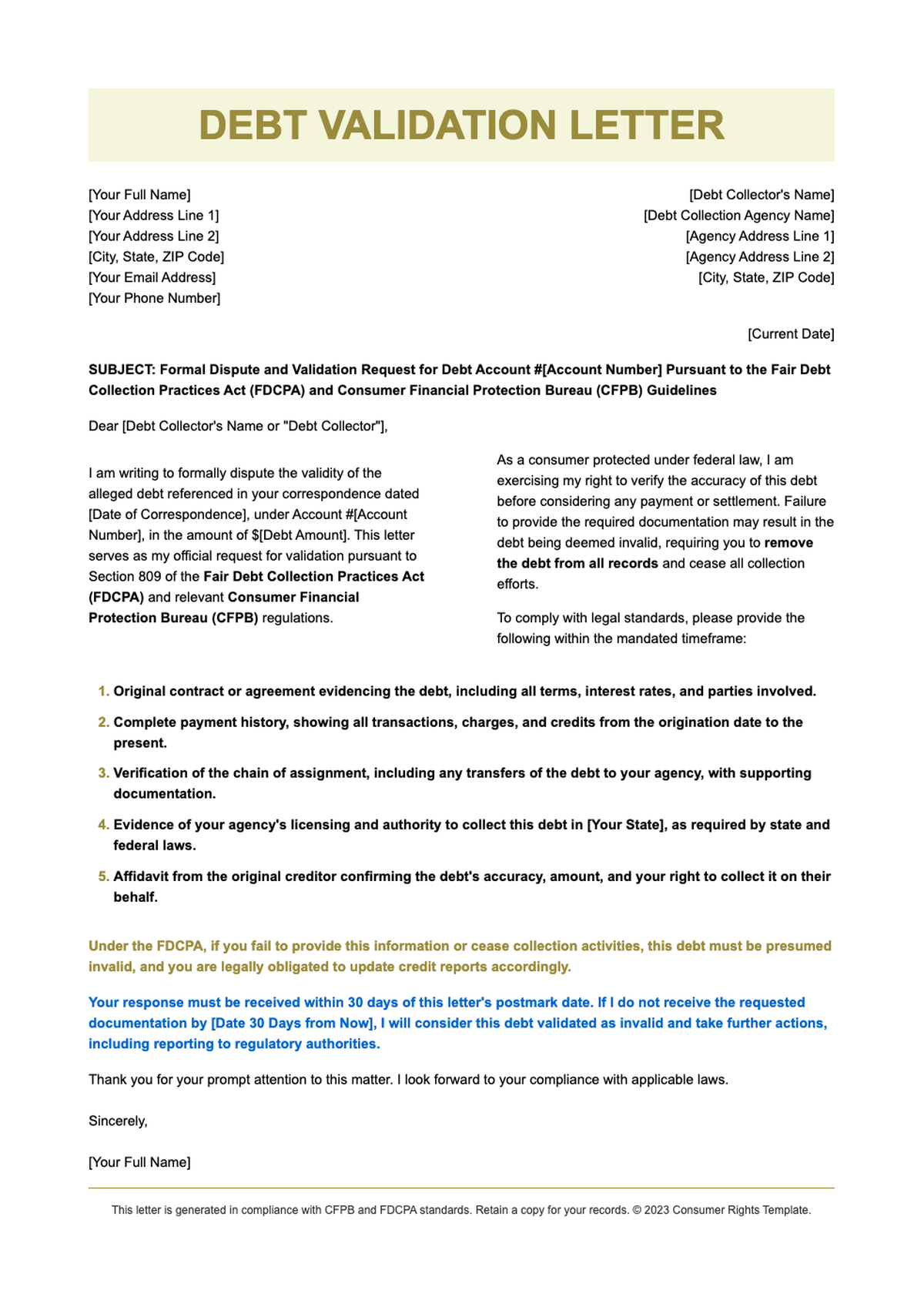

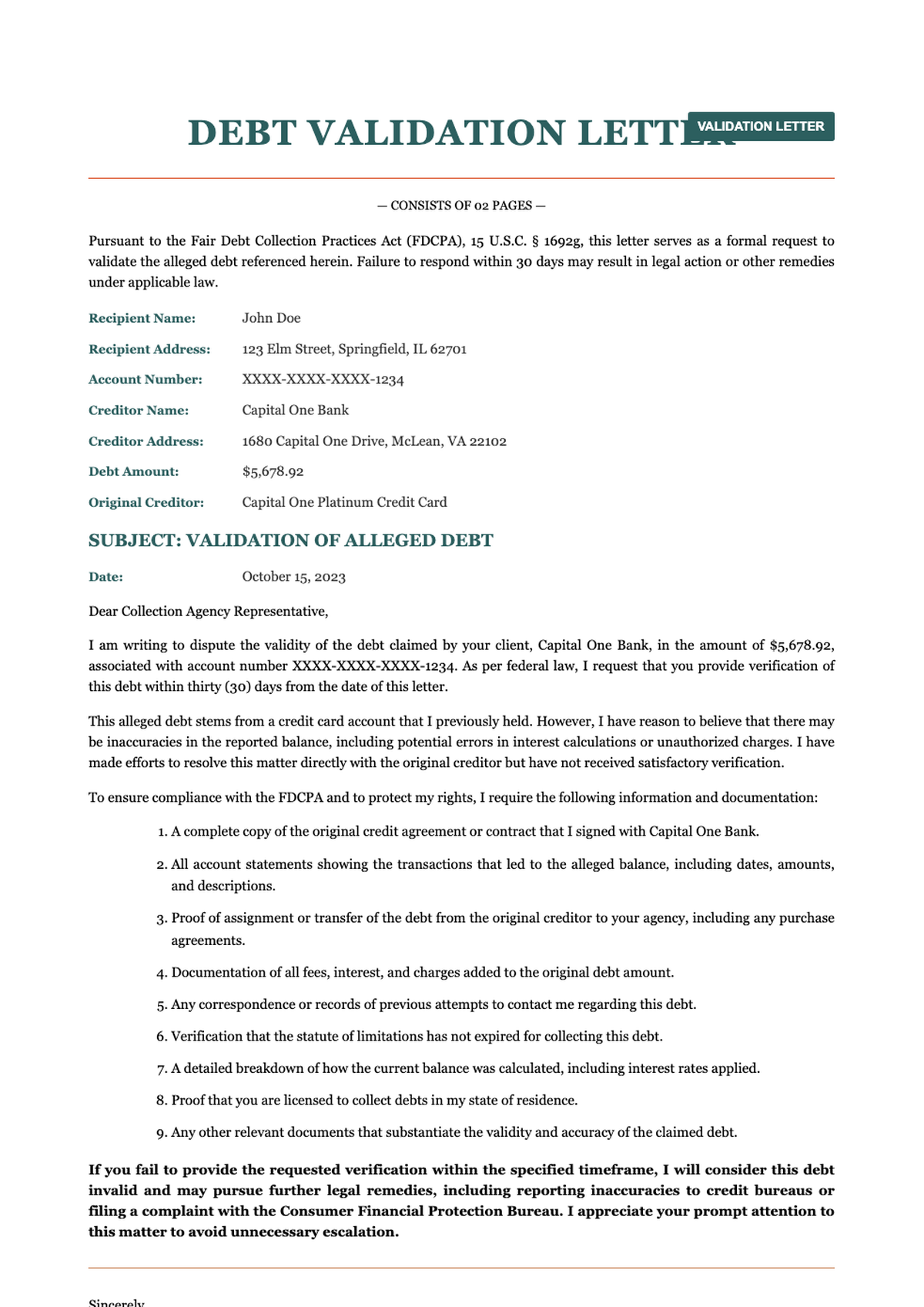

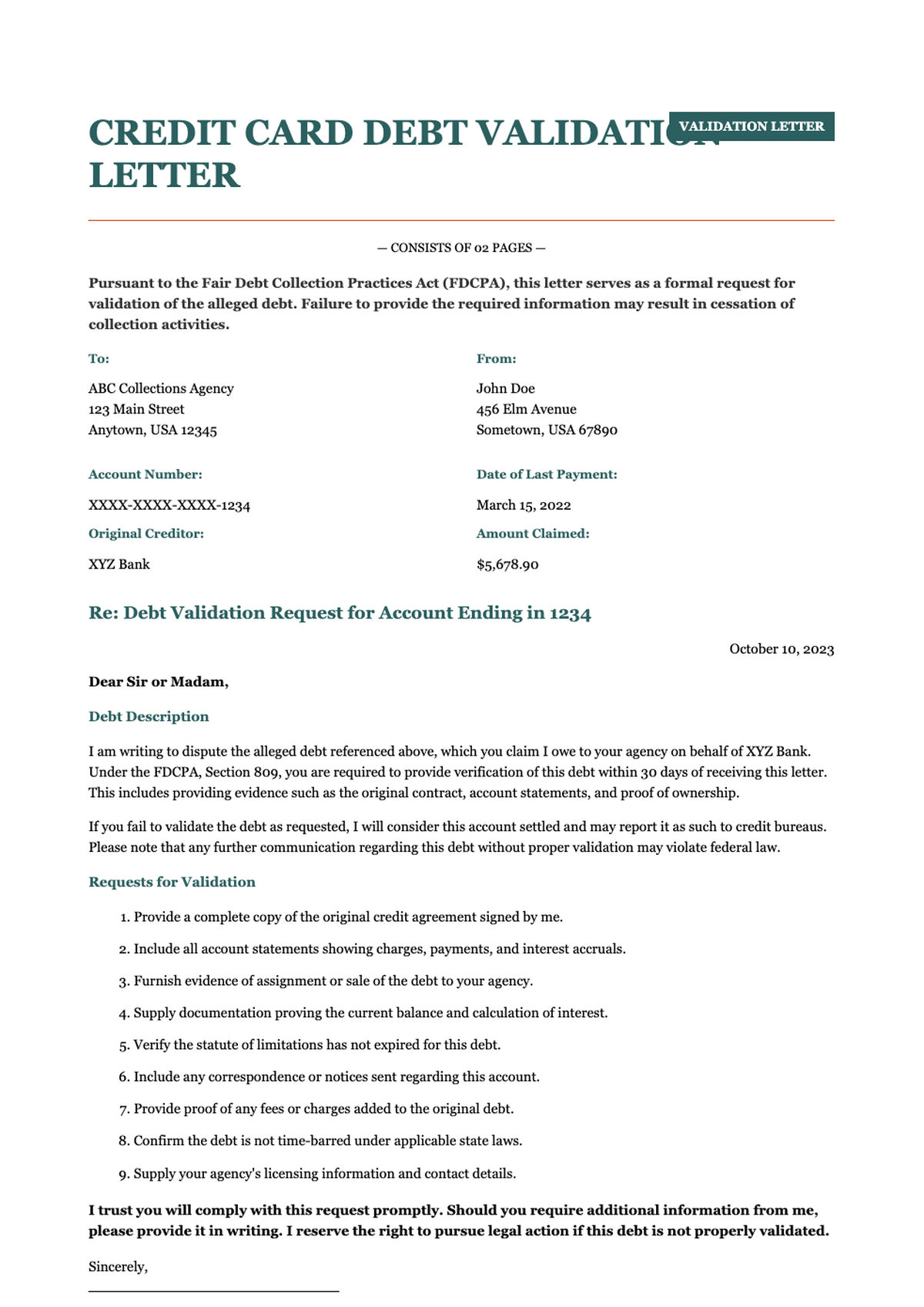

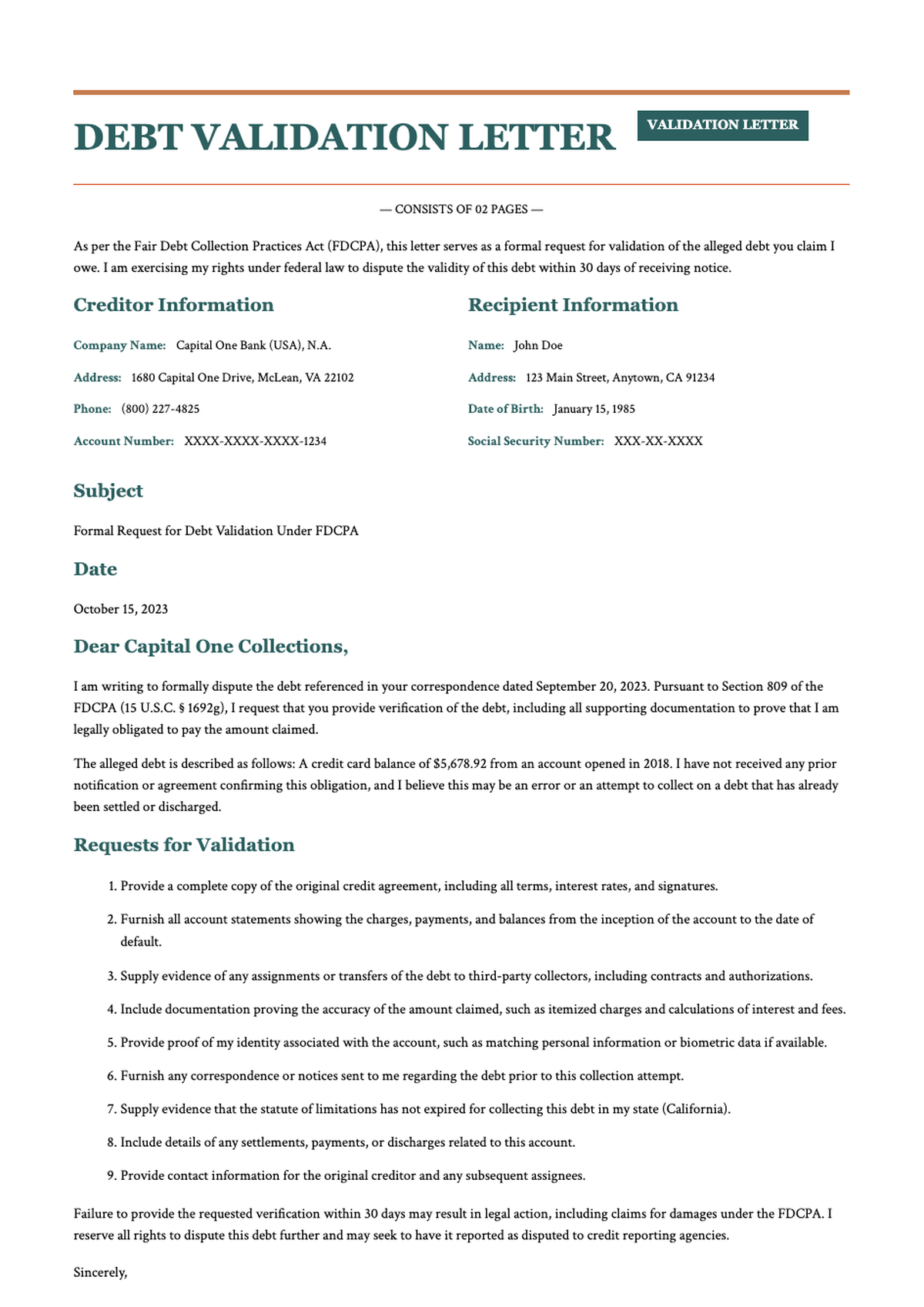

- What is a Debt Validation Letter?

- A Debt Validation Letter is a written request sent to a debt collector asking them to prove that you owe the debt and that they have the legal authority to collect it. This is your right under the FDCPA and can stop harassment while they verify the debt. The Fair Debt Collection Practices Act gives consumers powerful protections against abusive collection practices. When properly used, a validation letter can lead to debt removal if the collector cannot provide adequate proof of the debt validity.

- When should I send this letter?

- You should send a validation letter within 30 days of first being contacted by a debt collector. Sending it promptly requires them to pause collection efforts until they provide proof. The 30-day window is critical for preserving your full legal rights. After 30 days, collectors can continue collection even without validation, though many still respond. Mark your calendar from the first contact and send your letter via certified mail to ensure proof of delivery within this crucial timeframe.

- Will this stop the debt collector?

- Legally, once they receive your request, they must stop contacting you for payment until they provide the validation documents. If they cannot validate the debt, they may stop collection attempts entirely. Continued violations can be reported to the FTC and CFPB. Each violation can result in statutory damages of up to $1,000, so document any continued contact. Many consumers find that disputed debts are simply dropped by collectors who cannot produce the required documentation, making validation a powerful tool.

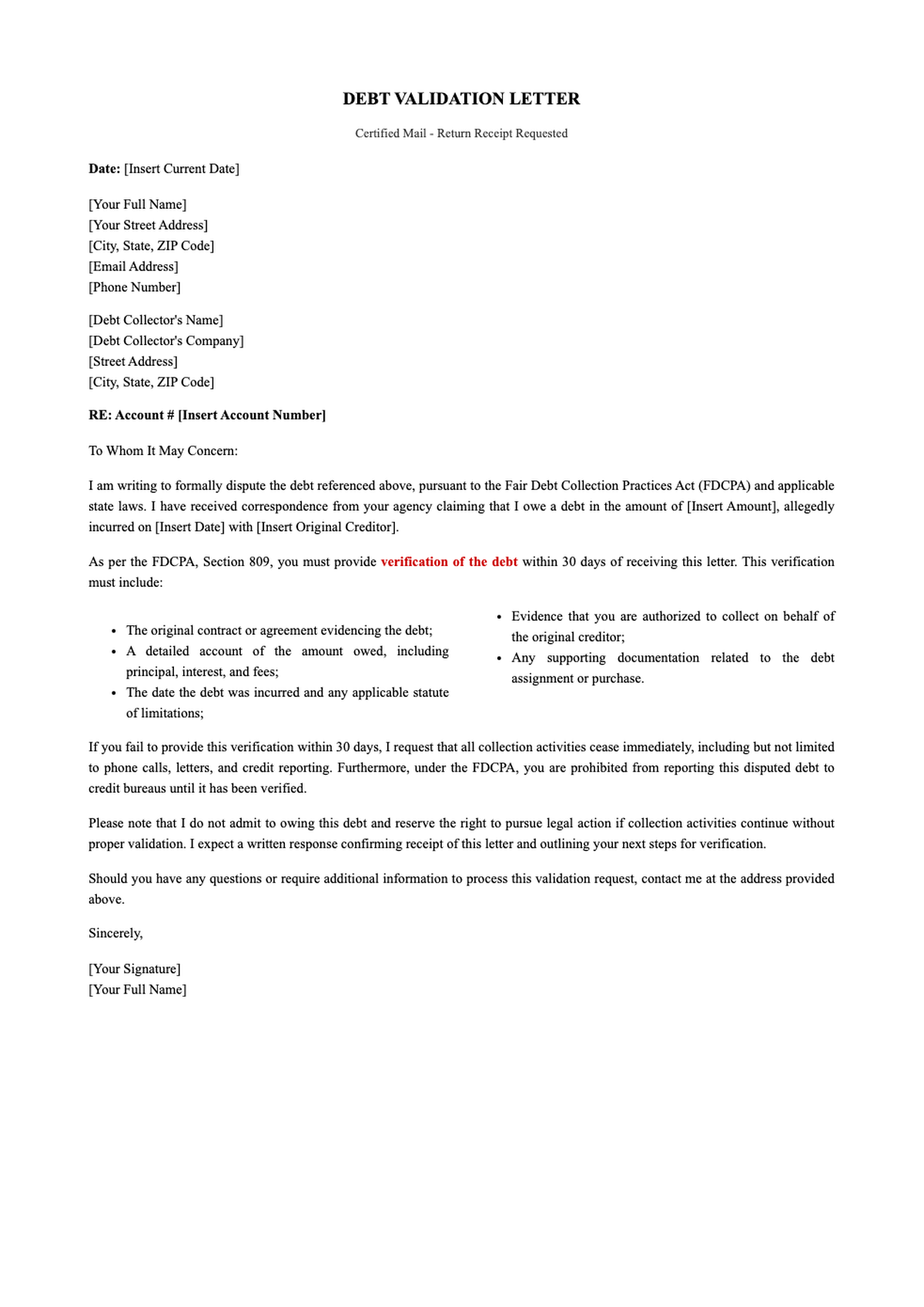

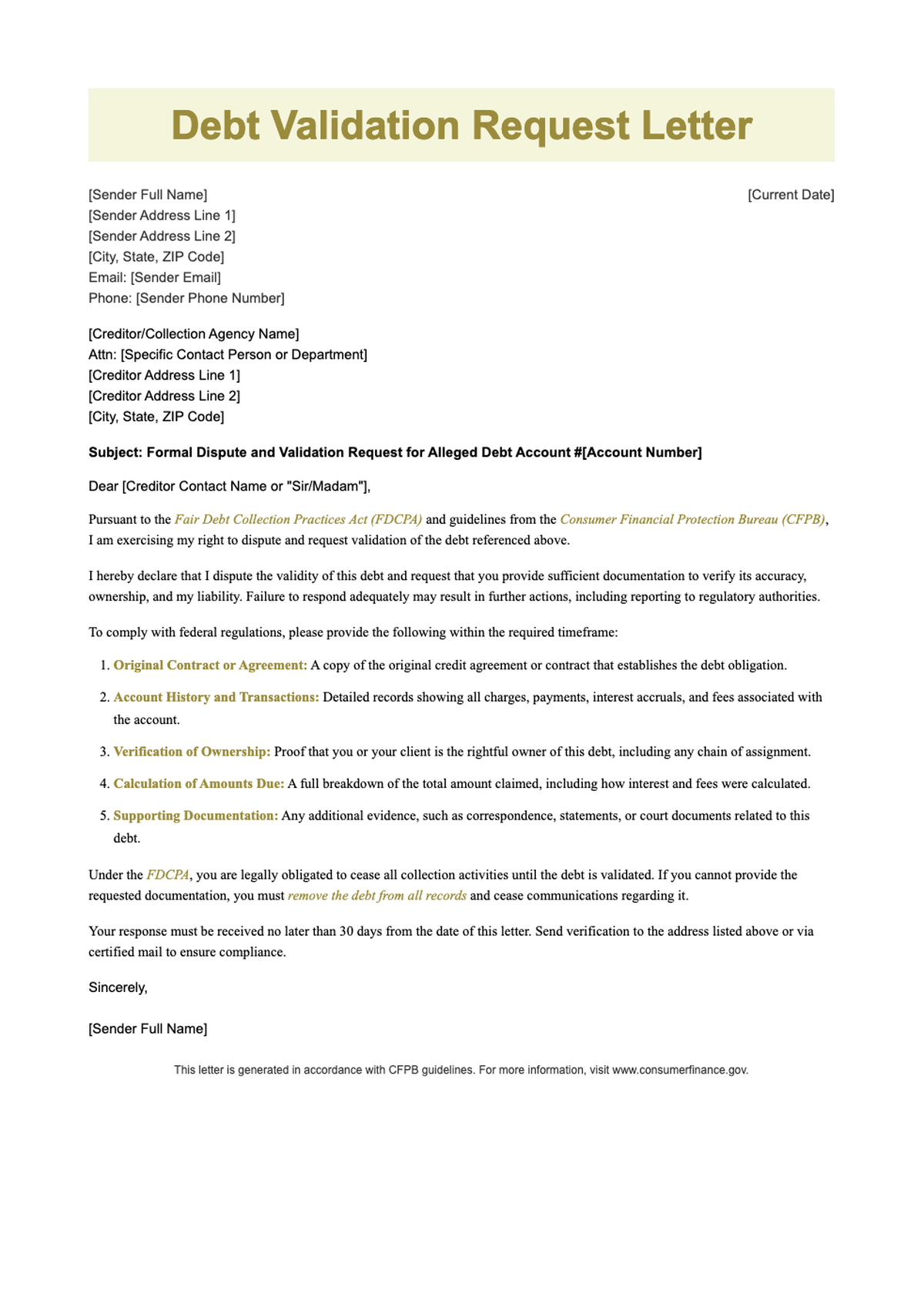

- Should I send it via certified mail?

- Yes, it is highly recommended to send your Debt Validation Letter via certified mail with a return receipt. This gives you legal proof that the collector received your request and creates a paper trail that can be used if they violate your rights. Certified mail requires a signature upon delivery, and you will receive a receipt showing who signed and when. This documentation is invaluable if you need to file a complaint or take legal action later. Keep the receipt and copy of the letter in your records.

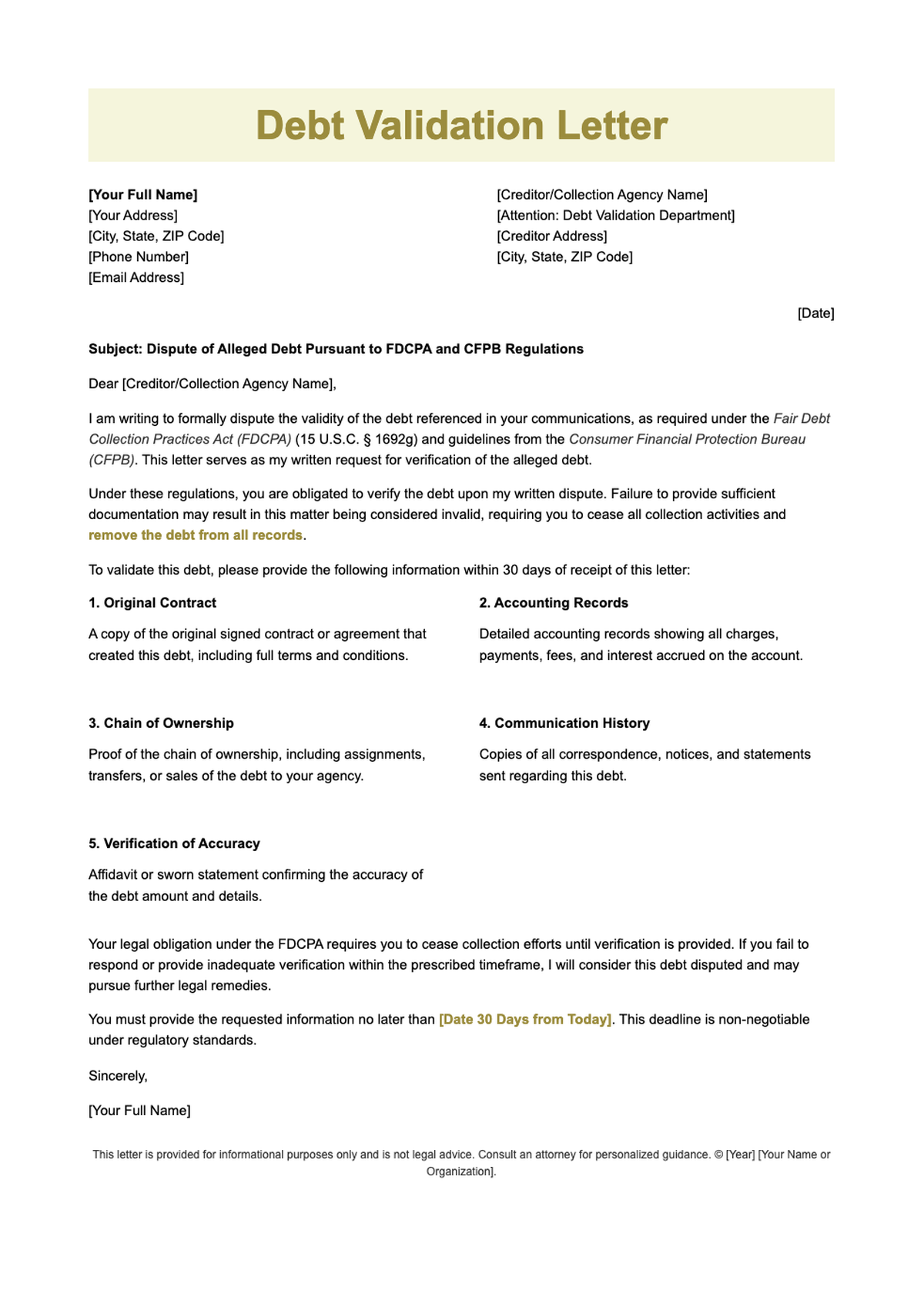

- What proof must the collector provide?

- If they cannot provide proper validation, they must cease collection efforts and cannot report the debt to credit bureaus. You have the right to demand they remove any negative credit reporting related to that debt. This is one of the most powerful aspects of the FDCPA. Without validation, the collector has no legal right to collect the debt or report it to credit agencies. If they continue collection activities without validation, they are violating federal law and you may have grounds for a lawsuit against them. This can result in debt removal and damages.

- What if they cannot validate the debt?

- If they cannot provide proper validation, they must cease collection efforts and cannot report the debt to credit bureaus. You have the right to demand they remove any negative credit reporting related to that debt. This is one of the most powerful aspects of the FDCPA. Without validation, the collector has no legal right to collect the debt or report it to credit agencies. If they continue collection activities without validation, they are violating federal law and you may have grounds for a lawsuit against them.

- Can I send a validation letter after 30 days?

- While you can still send a letter after 30 days, the collector is not legally required to stop collection activities. However, many will still respond to validation requests, and it puts them on notice that you know your rights. Some collectors may honor the request as a matter of policy even when not legally required. It is always worth sending because it may still result in validation or removal of inaccurate information. Even late, it demonstrates that you are an informed consumer who understands your protections.

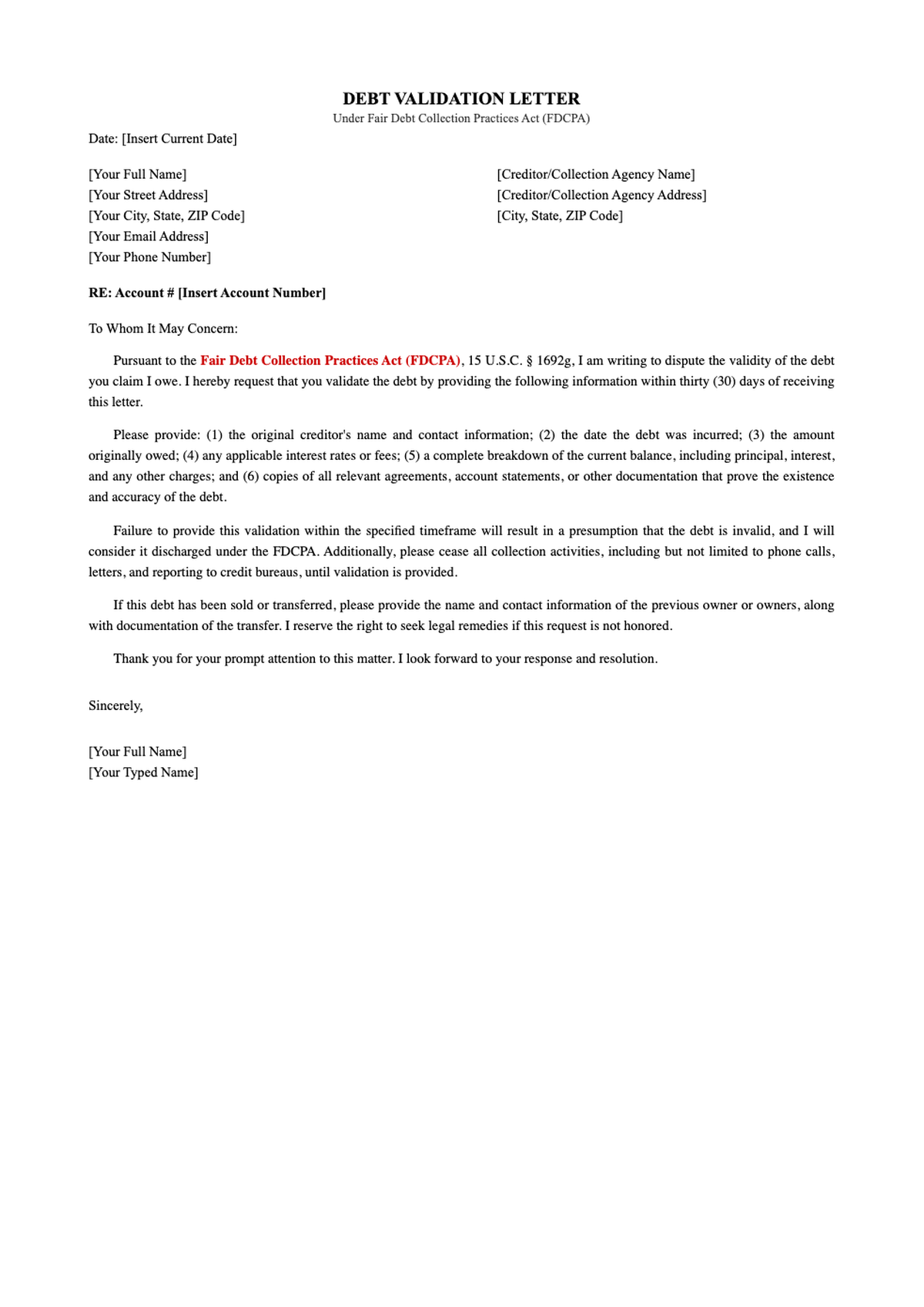

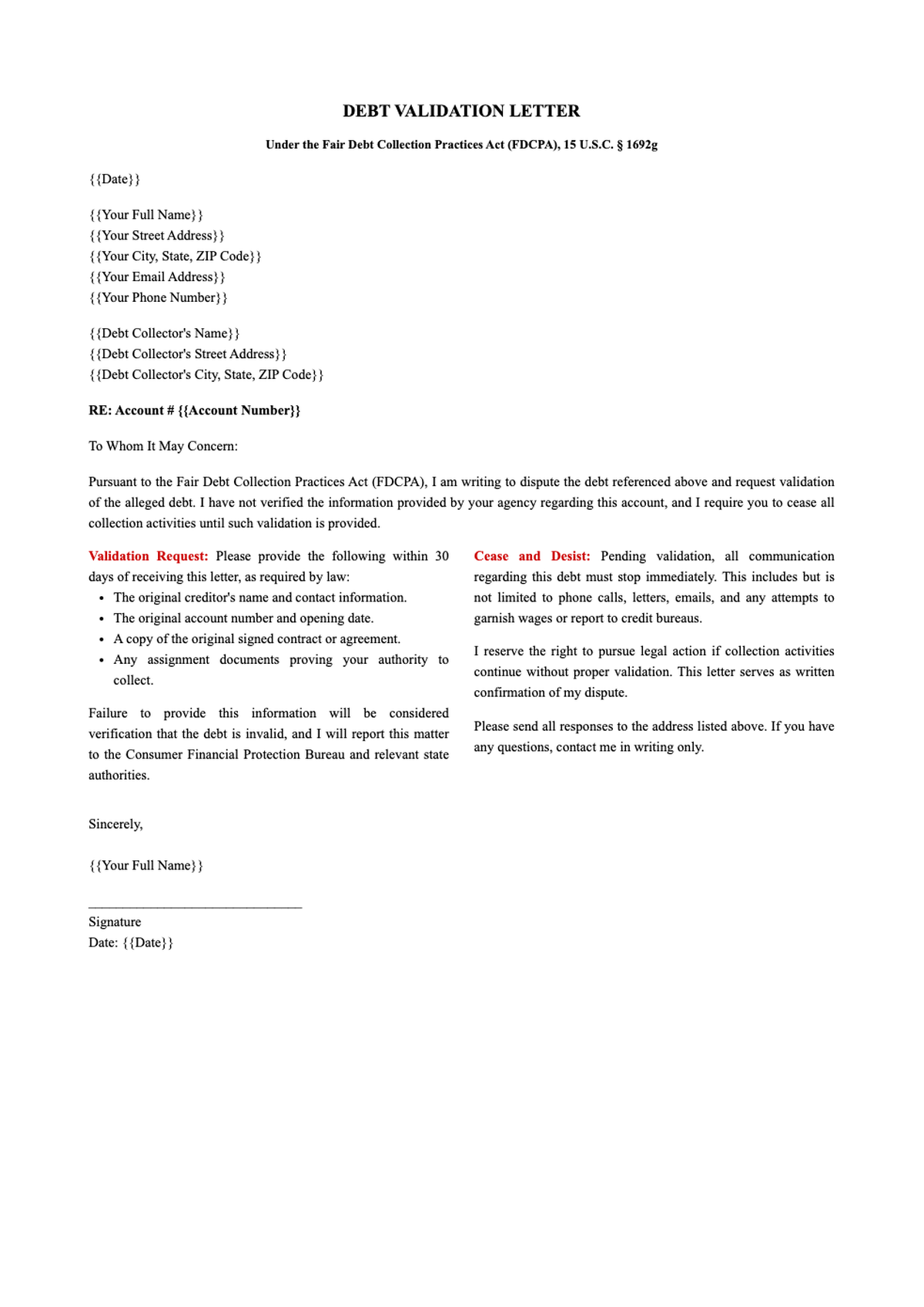

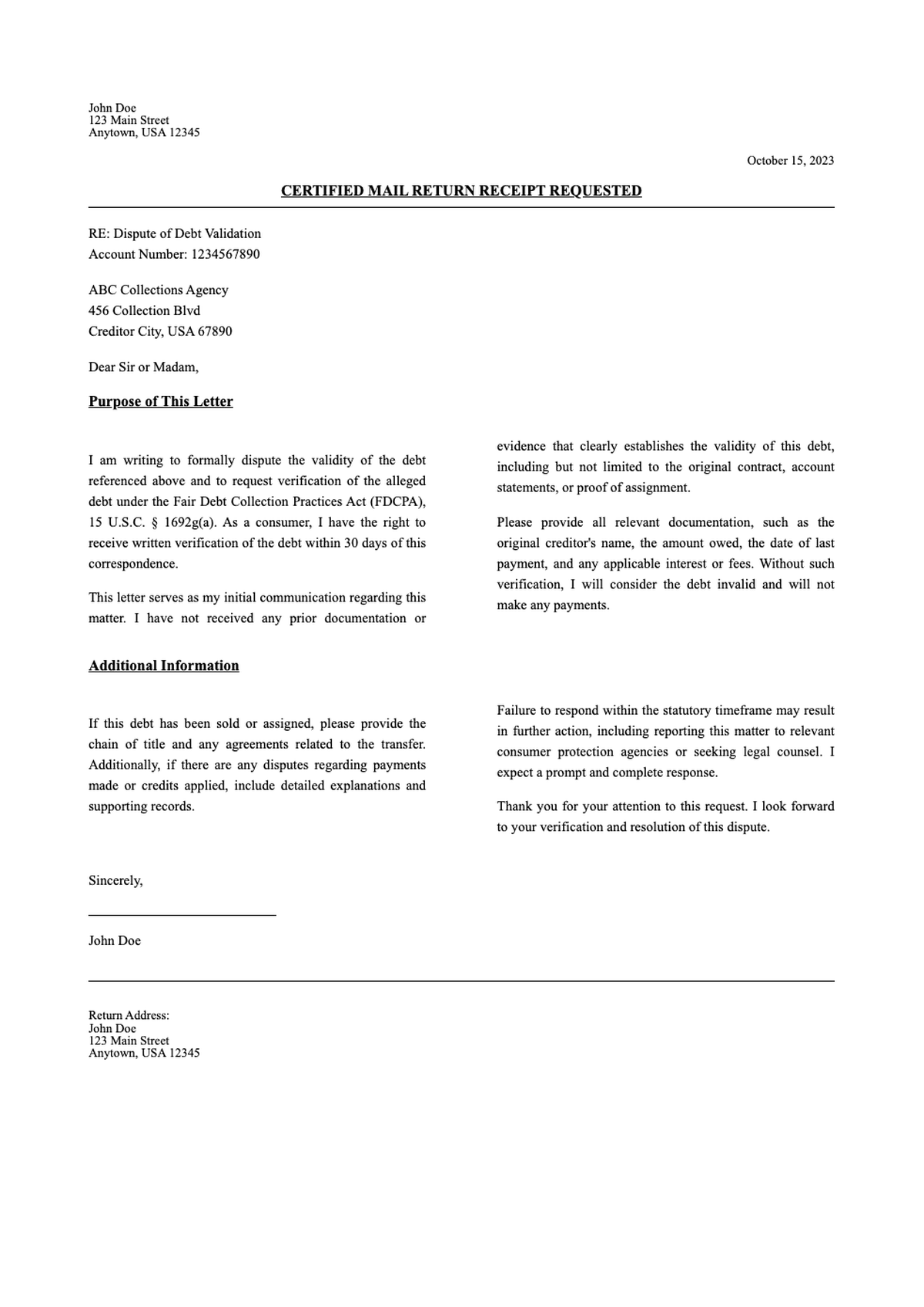

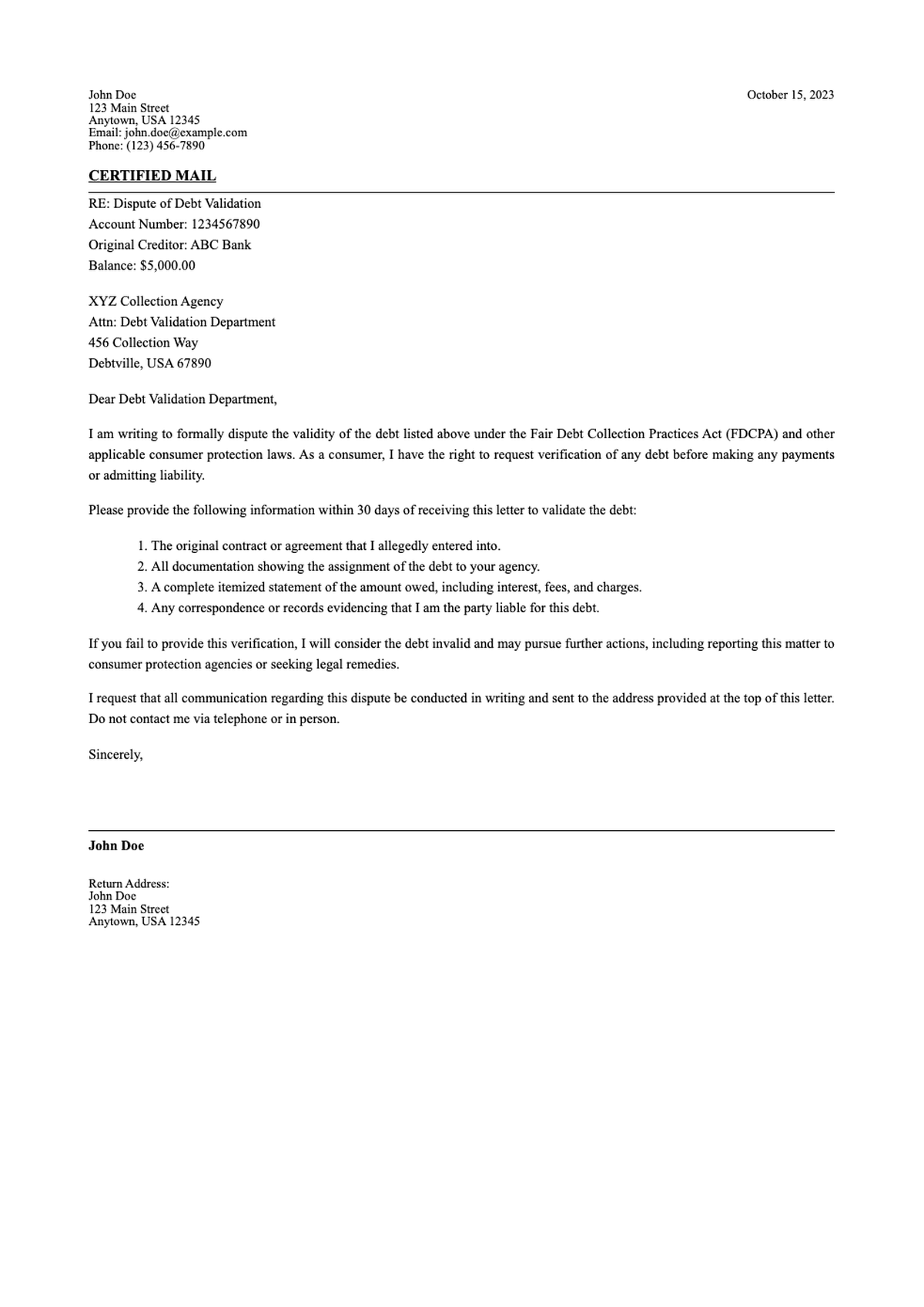

- What should I include in my validation letter?

- Include your account number, the amount claimed, a statement that you are requesting validation under the FDCPA, and a demand that they cease communication until validation is provided. Our templates include all required legal language. Also include your personal information and the collector details. Be clear that you are disputing the debt and require verification before any further communication. The letter should be sent certified mail so you have proof of delivery. Keep a copy for your records.

- Does this work for all types of debt?

- Debt validation is most effective for third-party debt collectors rather than original creditors. It works for credit cards, medical bills, personal loans, and other consumer debts covered by the FDCPA. Original creditors like banks or hospitals are not bound by the FDCPA validation rules. However, if a debt has been sold to a collection agency, validation rights apply. Some types of debts like government loans or taxes may have different procedures, so check the specific laws that apply to your situation.

- What if they continue calling me?

- Document every call with date, time, and caller name. If they continue after receiving your validation letter without providing proof, they are violating the FDCPA. You can file complaints with the CFPB, FTC, or your state attorney general. Keep detailed records including call logs, voicemails, and letters. Each violation can potentially result in statutory damages of up to $1,000 per violation, so documentation is crucial. Many consumers successfully sue collectors who ignore validation requests and continue harassment.

- Can a validation letter remove debt from my credit report?

- If the collector cannot validate the debt, they must remove it from your credit report. Even if they can validate, you can use the validation process to negotiate a pay-for-delete agreement or dispute inaccurate information with credit bureaus. Pay-for-delete means you agree to pay a portion of the debt in exchange for complete removal from your credit report. Get any agreement in writing before making payment. You can also dispute directly with credit bureaus if the validation shows errors or if the debt is beyond the statute of limitations.

- Do I need a lawyer to send a validation letter?

- No, you do not need a lawyer. Our templates are designed to be legally compliant when filled out correctly. However, if you are facing a lawsuit or have complex legal issues, consulting with a consumer rights attorney may be beneficial. Many attorneys offer free initial consultations for FDCPA cases. If the collector violates your rights after receiving the validation letter, you may be entitled to damages and the attorney may take your case on contingency. For straightforward validation requests, most consumers can handle it themselves.

- What is the difference between validation and verification?

- Validation is requesting proof that a debt collector has the right to collect and that the debt exists. Verification is the process of correcting inaccurate information with credit bureaus. Both are important tools for managing debt and credit. Validation happens between you and the collector, while verification involves the credit bureaus. You might use validation first, then if information on your credit report is inaccurate, use verification to dispute it there. Understanding both processes helps you comprehensively address debt issues.

- Can I negotiate after sending a validation letter?

- Yes, absolutely. Once they validate the debt, you can negotiate a settlement for less than the full amount. Many collectors are willing to accept significantly less, especially if the debt is old or they know you have limited ability to pay. Start by offering a lump sum that is a percentage of the total, typically 30-50%. Get any settlement agreement in writing before making payment. Ensure the agreement specifies that the debt is considered settled in full and that they will update or remove it from your credit report accordingly.

Protect Your Rights Today

Don't let debt collectors harass you. Download a validation letter template and demand proof.

Free templates • AI-powered editing • No sign-up required